Seasonal growth for pubs in December, reports Moore Kingston Smith

- katherinedoggrell

- Jan 16

- 4 min read

The Moore Kingston Smith monthly hospitality sector report found that,

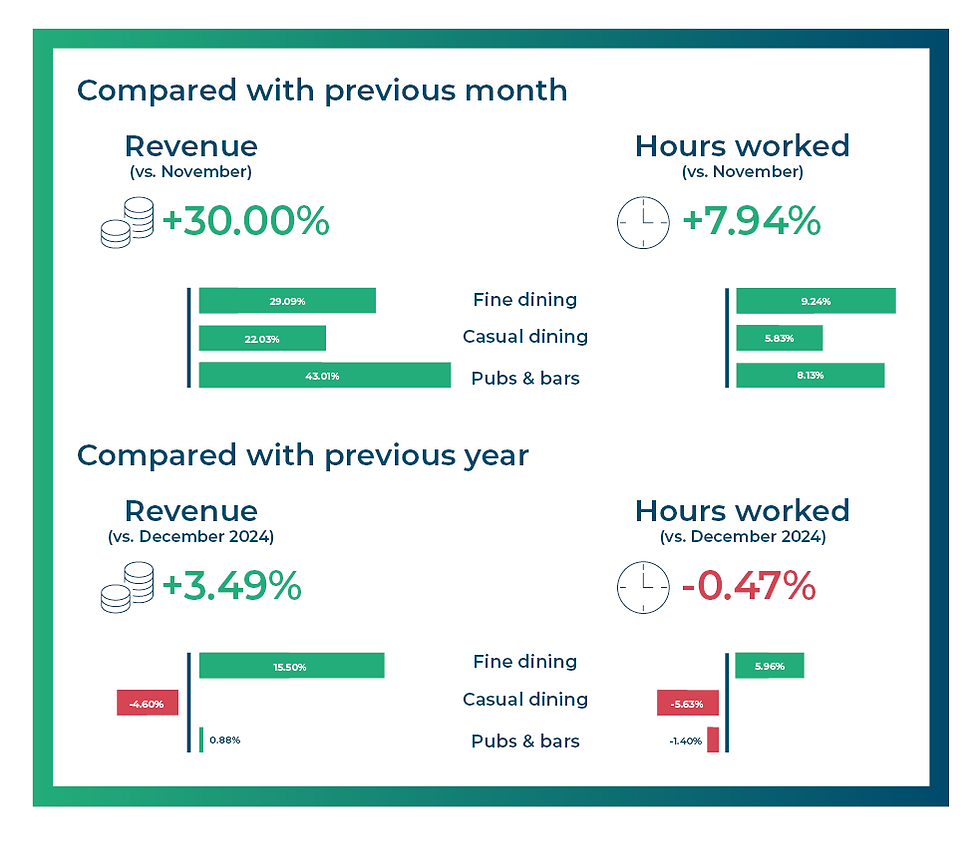

in December 2025, restaurants, pubs and bars observed the anticipated seasonal growth compared to the prior month, as revenue soared by 30.00% and hours worked increased by 7.94%.

The festive period boosted consumer demand for social gatherings and dining experiences, highlighting the industry’s dependency on a peak seasonal trading window and its impact on sustainable financial performance. The increase in hours worked reflects the operational requirement to manage higher footfall and maintain service standards during peak trading periods.

The Fine Dining segment showcased a substantial surge, achieving a 29.09% increase in revenue alongside a 9.24% increase in hours worked on a like-for-like basis. While this growth is primarily fuelled by seasonal demand, Fine Dining continued to outperform other areas of the hospitality sector, reflecting lower consumer price sensitivity within the segment. Consumers have demonstrated a clear ability to spend on high-quality dining experiences during the Christmas break. An increase in corporate events and social gatherings have played a key role in supporting this seasonal uplift, underscoring the segment’s capacity to capitalise on increased demand during peak season.

As expected, Pubs and Bars enjoy the strongest seasonal boost growth, recording a 43.01% increase in revenue alongside an 8.13% rise in hours worked relative top November 2025 (on a like-for-like basis). These figures outline the heightened demand during the festive period.

Casual Dining recorded a 22.03% uplift in revenue, accompanied by a 5.83% increase in hours worked. Revenue growth was driven by a mixture of competitive pricing strategies, seasonal menus and promotional offers, helping to attract value-driven customers seeking quality experiences without compromising on social engagement. However, Casual Dining continues to trail behind other segments in revenue growth, suggesting that further innovations will be vital to close the gap and sustaining long-term growth.

December 2025 vs December 2024

In real terms the restaurants, pubs and bars experienced a relatively flat like-for-like trading compared to 2024. Revenue for December 2025 compared to the same period in 2024 showed overall growth of 3.49% – broadly in line with inflation and therefore offering limited improvement in real term profitability – the experience varied significantly across subsectors. Meanwhile, a 0.47% reduction in hours worked across the sector underscores a strategic commitment to manage costs through improved operational efficiency.

Once again, the Fine Dining segment observed the strongest performance, as revenue increased by 15.50% alongside a 5.96% rise in hours worked. This indicates that luxury establishments are successfully meeting sustained consumer demand for premium experiences, while effectively managing operations and passing on inflationary cost increases. Even amongst the backdrop of an uncertain economic climate, the willingness for customers to consistently invest in quality dining emphasises the resilience of the demand in this segment.

Pubs and Bars experienced a slight revenue increase of 0.88% on a like-for-like basis, along with a 1.40% reduction in hours worked. Inflation continues to outpace the segment revenue growth, operators are having to find ways to reduce labour costs to reduce the impact on profit margins as they seek a financially sustainable position. Sadly, many operators are struggling to operate profitably.

Casual Dining continues to struggle in the current market conditions, reporting a 4.60% decline in like-for-like revenue and a 5.63% decrease in hours worked compared to December 2024. The significant impact of ongoing cost-of-living pressures, with customers being more cautious with their discretionary spending, has led to a lower demand for everyday dining experiences. To ensure long term sustainability, operators are refining their staffing models to align workforce levels with the falling demand.

Hotels – November 2025*

*The hotel data reflects a period one month earlier than the restaurant data due to an industry reporting lag.

November 2025 vs prior month

In the Hotel sector, comparing November 2025 with October 2025, like-for-like revenue increased sharply by 14.98%. This growth reflects a rise in demand for accommodation and related services during the lead up to the festive period. On the contrary, hours worked only increased 0.29%, suggesting that hotels sought to capitalise on additional demand without significantly expanding their workforce.

November 2025 vs November 2024

When comparing November year-on-year data, although Hotels achieved a slight revenue improvement of 0.46%, while experiencing a 3.58% fall in hours worked this means the sector has not been able to keep up with inflation. There is a clear focus across the segment on cost control, reflected in the heightened reduction in labour hours. These adjustments indicate the response to cost pressures and changing consumer behaviour, whereby maintaining service standards with limited resources has become a critical challenge for operators.

Month-on-month summary

In conclusion, as anticipated, operators needed to ensure labour costs were tightly managed during the festive period.

Year-on-year summary

In summary, hospitality performance was mixed during the festive period, with Fine Dining leading growth due to resilient demand for premium experiences. Pubs and Bars and Hotels saw revenue fall in real terms, whilst Casual Dining continued to struggle as cost-of-living pressures reduced consumer demand. The consistent reduction in labour hours across the troubled segments indicates a deliberate and sustained shift toward leaner operations. This strategic approach reflects an industry determined to find long-term sustainability and optimise resources. Operators face enormous challenges in the short-term while preserving service quality and the real impact has been felt by workers with fewer hours available.

Comments