Sector sees January slump, reports latest Hospitality Sector Index

- katherinedoggrell

- 9 hours ago

- 5 min read

The Moore Kingston Smith monthly hospitality sector reports on the latast month-on-month and year-on-year changes occurring within the sector.

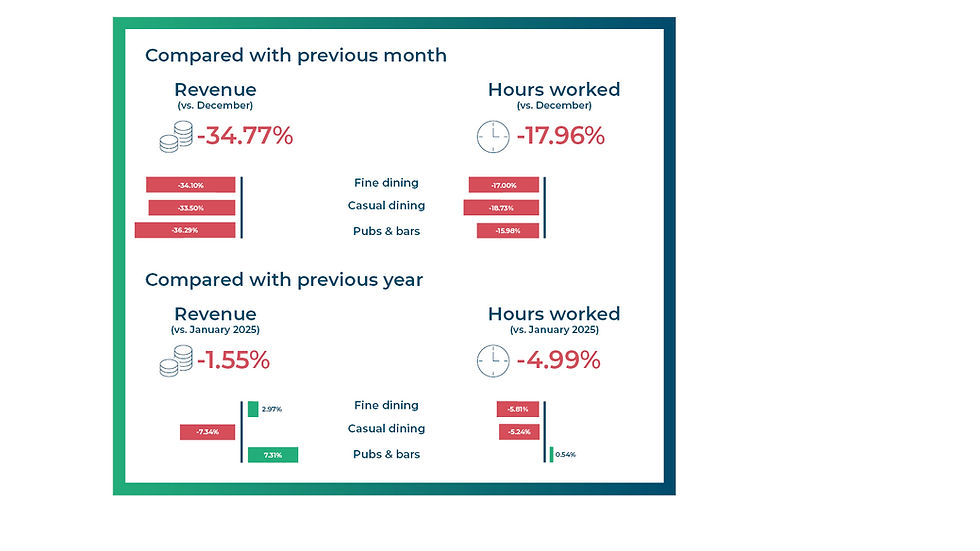

January 2026 vs prior month

Following the seasonal highs in December, the UK hospitality sector experienced a sharp downturn in January 2026, with revenue dropping by 34.77% and hours worked falling by 17.96%. This seasonal retrenchment corresponds with the typical slump we would expect following the festive period and is in line with the seasonal dip experienced in January 2025 (which recorded a total revenue decline of 34.96% and a 17.02% reduction in hours worked on a like-for-like basis).

The predictable declines in footfall and social occasions and less favourable weather all contributed to reduced demand in January. The reduction in hours worked highlights the sector’s ability to adapt to seasonal fluctuations, with operators streamlining staffing models to manage variable costs during a traditionally challenging trading period.

The Fine Dining segment recorded a substantial contraction, as revenue declined by 34.10% and hours worked decreased by 17.00%. This movement reflects a post-Christmas shift in behaviour, as consumers pull back from spending on luxury dining experiences after the financially demanding festive season. Furthermore, the predictable slowdown in corporate events and family outings further contributed to the reduced demand. However, when comparing to the January 2025 seasonality swing, the decline is even more pronounced than last year which saw a 31.18% drop in revenue and a 19.44% fall in hours worked (on a like-for-like basis).

Casual Dining observed a 33.50% reduction in revenue, alongside a 18.73% decrease in hours worked. Again, the significant drop in revenue illustrates the decline in discretionary spending typically seen in January, as consumers scale back on dining out following the costly festive period. The reduction in hours worked highlights management’s efforts to align staffing levels with quieter trading conditions and fewer covers.

Pubs and Bars experienced the most dramatic seasonal decline, recording a 36.29% decrease in revenue alongside an 15.98% drop in hours worked compared to the prior month. This sharp fall is amplified by the sector’s exceptionally strong performance in December, when Christmas trading pushed revenues to their annual peak. The combination of coming down from those festive highs and challenging market conditions at the start of the year has intensified the downturn. The growing campaigns for additional support for Pubs and Bars should not fall on deaf ears, the seasonal drop from the heights at Christmas is even more pronounced this year: the seasonal swing last January saw like-for-like revenue decrease by 29.57% and hours worked reduced by 10.07%.

January 2026 vs January 2025

The pressures on the UK hospitality sector are evident in the contraction in January 2026 when compared to the same period in 2025, with revenue falling by 1.55% despite the inflationary pressure on prices seen across the economy. Operators faced a softer trading environment than expected for the post-Christmas period, as tighter discretionary spending habits were observed. A 4.99% reduction in hours worked highlights an industry wide emphasis on cost control, as businesses adopt more streamlined staffing models to limit the financial impact.

The Fine Dining segment continues to show greater resilience than the other areas within the sector, reporting a 2.97% increase in year-on-year revenue amid a 5.81% fall in hours worked relative to Jan 2025 data. The increase in revenue reflects continuing demand for premium dining establishments, suggesting that this segment continues to enjoy consumers remaining willing to spend for a high-quality experience. These operators continue to refine labour models, with the need to remain focussed on productivity and improving operational efficiency whilst seeking to maintain standards.

Casual Dining remains under extreme pressure, with the segment observing a 7.34% decline in revenue and a 5.24% decrease in hours worked (on a like-for-like basis vs January 2025). This performance underscores a continued shift in consumer spending habits, with many households cutting back on everyday dining experiences as discretionary budgets tighten. While operators have adjusted their staffing levels, the reduction in hours worked could not offset the fall in revenue. This illustrates how many Casual Dining businesses are struggling under financial pressures and are simply unable to find any further opportunities to make savings in their labour costs.

Maintaining profitability amongst such a backdrop is simply not possible.

Pubs and Bars reported a sharp revenue increase of 7.31%, accompanied by only a 0.54% increase in hours worked (on a like-for-like basis) relative to January 2025. These figures offer perhaps some hope as revenue increases outpaced inflation. Part of this uplift may stem from widespread “support your local” campaigns, which appear to be resonating with consumers. In addition, many pubs have broadened their range of high-margin, low- or non-alcoholic options—such as low-percentage beers and alcohol-free wines—encouraging customers to choose these premium alternatives over traditional soft drinks. This shift in purchasing behaviour has supported revenue growth despite only marginal increases in labour hours. The very modest increase in labour hours indicates operators’ desire to manage costs and the disparity between revenue growth and labour hours growth provides an insight into the cautious approach operators are taking towards resource management.

Hotels – December 2025*

*The hotel data reflects a period one month earlier than the restaurant data due to an industry reporting lag.

December 2025 vs prior month

In the Hotel sector, comparing (on a like-for-like basis) December 2025 with November 2025, revenue increased only slightly by 0.52%. This is attributed to an uplift in bookings during the Christmas season crammed into what is realistically a shorter month. In contrast, hours worked decreased by 2.13%, suggesting that hotels continue to prioritise operational efficiency. Furthermore, this trend indicates a strategic shift towards leaner staffing models, as operators look to protect profitability.

December 2025 vs December 2024

When comparing December year-on-year data, the Hotel segment reported a 4.47% decline in revenue and a 5.67% reduction in hours worked. These figures suggest that UK Hotels are under pressure and the hitherto resilience in the sector is perhaps now strained. The decrease in hours worked highlights the prolonged focus on preserving profitability, as labour costs are clawed back to offset weaker revenue. Together, these trends outline a UK market where demand has softened, with operators responding with more disciplined staffing strategies.

Month-on-month summary

As expected, the UK hospitality sector observed a significant slowdown in January 2026 as trading naturally falls back following the busy festive season. Demand fell across the industry, influenced by tighter consumer discretionary spending and the annual shift toward healthier habits and reduced socialising. When compared with January 2025, the latest figures remain broadly consistent with the usual post‑Christmas patterns, although the data reveals some deviation in performance across the different categories within the sector and the Pubs and Bars felt the biggest seasonal slump following the highs in December.

Year-on-year summary

The hospitality sector remains under immense pressure. The sector declined in absolute terms over the 2025 year despite the stubborn inflation in the economy. Many consumers entered the New Year with more caution around discretionary spending suggesting that the broader economic pressures and uncertainty continues to affect consumer behaviour, reflected in the downturn in both casual dining and everyday leisure activities.

Operators continue to respond as best they can by managing labour costs, highlighting the understandably cautious stance being taken by operators. The adjustments suggest that the sector remains focused on minimising the damage to margin as far as possible through leaner staffing models, with an emphasis on operational efficiency across the sector. The year‑on‑year changes show the hospitality industry continues to suffer as consumers are forced to adapt their spending.

Comments